Q3 recap / WTI $95, SPR / Costco gold / SPX500 200dma key / ALL about credit markets now into Q4

- rmd005

- Sep 28, 2023

- 4 min read

Yields on 10's UST closed on new post 2007 highs yesterday, WTI closed at the highest level for over 12mos and the euro looks to be breaking through 1.0500 - key long-term level >>> ALL about credit now, ( the like sof #JNK #HYG ) which is beginning to move, perhaps the surprise is how well behave they have been so far...relatively speaking, so beware, this IS key for Q4

Tesla CEO Elon Musk Slams Biden For Supporting UAW Demands: 'Sure Way To Drive GM, Ford And Chrysler Bankrupt' >>> suspect Elon fears that his work force calls him out with big wage increase too...

Petrobras is recruiting Chinese banks to finance its deepwater oil expansion in a sign of growing ties between Brazil’s state-controlled oil company and the world’s second-biggest economy

The US Department of Justice escalates a probe into Credit Suisse and UBS over suspected failures that allowed Russian clients to evade sanctions

Fed's Kashkari confirmed his hawkish stance, in terms of the dot plot, reiterating his views from his essay from Monday, his base case seems to be one more hike later this year (5.625% for 2023) and no rate cuts in 2024 (5.625% for 2024). That means Kashkari's 2024 dot was the second highest. Fed's Bowman's rate expectation appeared to be the most hawkish on the Committee based on recent speech

China Evergrande has suspended trading on its shares as well as the shares of its other units listed in Hong Kong. This is occurring in the midst of continued debt troubles and reported police surveillance of its chairman

Costco is selling gold bars : CEO said "I've gotten a couple of calls that people have seen online that we've been selling gold - 1 ounce gold bars, yes, and when we load them on the site, they're typically gone within a few hours and we limit two per member."

The WGA is calling its new deal "exceptional." Here's why. Hollywood writers have secured a better deal on pay, AI, and residuals

JPMORGAN: “.. we are not saying that the situation now is the same as in 2007-2008 .. But signs of stress are beginning to appear. .. lags are longer this time, which has resulted in complacency and broad acceptance of the soft landing, or even no-landing, thesis ..” (Kalonovic - he may get his day, though he's always been bearish)

Percentage of credit card and auto loan balances transitioning to serious delinquency have surpassed pre-pandemic levels/Fitch

Nikki Haley unveils economic proposal while slamming both parties over government spending >>> ''If Congress doesn’t pass a budget, they shouldn’t get paid. No budget, no pay''

Markets :

Leverage and higher interest rates don't mix well

Bond markets : beginning to look like the biggest sell-off in history..certainly the pace of it >>> which may well have been exaggerated with quarter-end flows and since FOMC reset (+50bps in 2024) and markets giving up and accepting the 'high for longer' which we've talked about for over 6months >>> we may well go to 5% in 10's UST, but proceed cautiously from here, take some profits, if you followed the advice and went short bonds, steeper play etc..

USDollar stayed firm on yields diff, and got another BID tone into quarter-end, similar story, well flagged, we may correct a little softer into October, but the differential remain the same, BoJ will eventually capitulate, but again market need to perhaps challenge them 150JPY+ first, USDCHF has doen some very good work after the 'SNB hold', woul dnot be shocked if we go towards 1.0000 now though >>> tough to be short usd, it's very expensive..

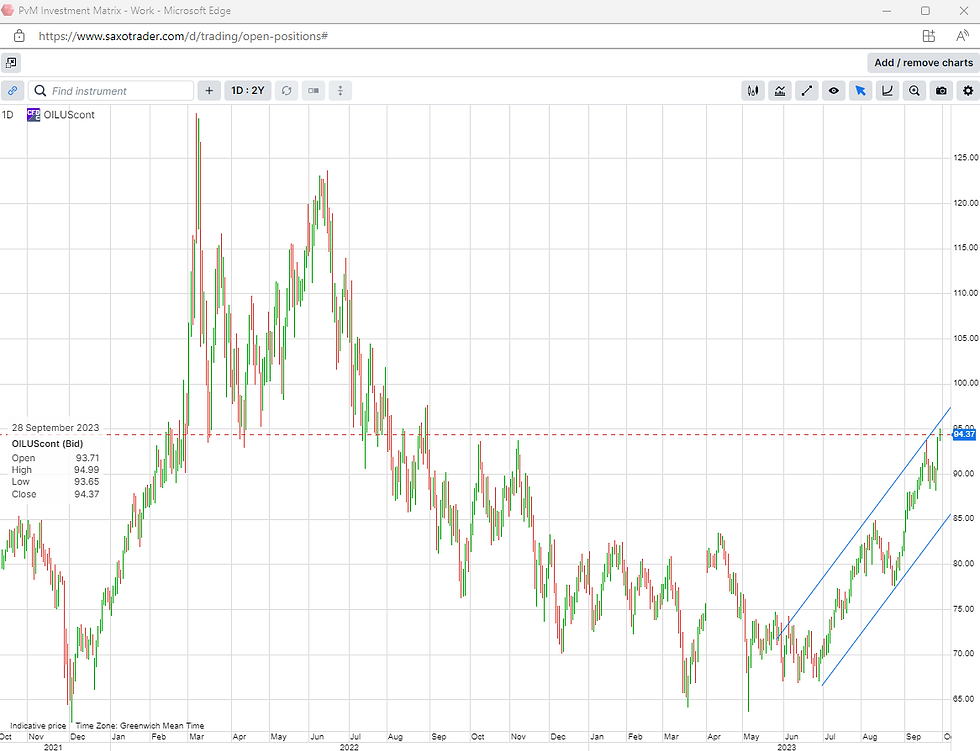

Crude rallied 2-3pct again y'day!, WTI 95$, reaching the levels we talked about 3months ago...now the whole street is getting pretty bullish, staying with it, key whether Saudi were to increase prod >>> Oil is back to where it was a year ago but the US SPR now has 250MM fewer barrels of emergency oil

Equity markets : we reached Aug lows on QQQ and bounced yesterday off those levels, reaching slightly oversold levels in SPX500 and Nasdaq (most oversold since Nov 2002 - but let's face it we hardly moved last 3-6months, so we got very easily into oversold level..), SPX500 200dma is around 4200, is the first big line of support for going into Q4

Many pointing out still that the equal weighted S&P500 is now flat for the year, while the big '7' are up about 80%

BTP-Bund spread approaching uncomfortable levels again (credit..)

Overall, we remain cautious on macro side, as higher rates are definitely biting, lag effects, slowly hitting home

U.S got its manufacturing back, and now it also has the Unions that are back in a position of force, asking for big wage increases, can't blame them, but this will complicate things, we had 3 to 4 decades of globalization and manufacturing in China, with the West hunting for the cheapest labor forces, it's all but over..., onshoring is great and welcome, but it comes at a higher price...

Nikki Haley unveils economic proposal while slamming both parties over government spending (msn.com)

Not a good sing when top execs leave tha firm

Allegedly , if nominated, he could even govern from prison...if we get there, certainly the journey to next election will be lively!

WTI

EUTOstoxx50

DOW Jones

Comments