French decree on short flights / UK core infl up ⬆️/ CSI300,LVMH,Copper ⬇️ / U.S claims & PCE next

- May 24, 2023

- 4 min read

Pasta prices have surged, prompting crisis meetings in Italy and calls for a strike, mamma mia!

The French government published a decree Tuesday that banned domestic commercial airline flights for journeys possible in less than two-and-a-half hours by train, will it work?

US Data Tuesday was mixed: Flash PMI data on services was a beat but manufacturing a miss (UK, Germany, much the same..), US debt ceiling impasse: Negotiations extend as:

As funds run short, Treasury asks agencies if payments can be made later. Senior Biden aides are rummaging through the nation’s books, looking for new ways to conserve cash while Washington battles over the debt ceiling

“We can have a dramatically more prosperous future; but we have to manage risk to get there,” OpenAI CEO Sam Altman wrote

''At last! UK inflation falls below 10% for first time since August''.. It was 8.7% YoY in April, going in the right direction, BUT core higher...not great clearly!! >> June hike nailed on! and 'peak' rates up to 5.5% immediately..

Lithium developers... Brace yourself for the recovery. Geologist, James Cooper, offers his take on why developers could be entering a Goldilocks period as the lithium sector braces for a recovery

The IMF has today joined a group of top economic institutions in DITCHING its call that the UK will suffer a tough recession this year and Top officials at the Bank of England today admitted they have undershot the strength of inflation, with governor Andrew Bailey confessing the central bank has some “very big” lessons to learn over how it sets interest rates

-The US Secret Service said it had detained the driver of a rented box truck that crashed into security barriers near the White House, perhaps intentionally, but that there were no injuries or ongoing danger

RBNZ hikes 25bps to 5.25%, as expected, 2 dissent and a pause discussed >> NZD down almost 2%

Netflix password-sharing crackdown rolls out in the U.S.

China PM Li Qiang meets with Russia's Mishustin in Beijing. China and Russia sign MOU on service trade cooperation >>> overall CHINA data is much weaker than many economist expected few months back...!!, regional bankruptcies, copper, LVMH (luxury sector), bridges to nowhere (article yesterday)..all pretty bad signs on the economy there

Markets :

SPX500 'never' closed above 4200, 'may' be running out of steam ahead of VERY key data over next24hours, with PCE tomorrow, rates been ratcheting up lately. DAX topped at ATH's levels too, slight loss of momentum in short-term ahead of KEY macro data, and CSI 300 Index drops by 1.1%, erases 2023 gains. Luxury stocks topped out and got sold fairly hard yesterday too

USDollar will follow rates (2x UST up to 4.3%), CROSSJPY's had a good rally on +ve risk and higher global yields, all about macro U.S data and PCE

GOLD held where it should have for the bulls - $1950, Copper down again

U.S debt ceiling drama continues, beginning to think they kick the can down the road to after the summer..

Copper price slides as global demand drops sharply. LME stockpiles build up rapidly as European industrial activity cools

Los going on over there - hard to know exactly what's what..!

A Poor Province in China Splurged on Bridges and Roads. Now It’s Facing a Debt Reckoning. - WSJ just fabUlous bridges! ithas ot be said, but.. >> Michael Pettis on Twitter: "1/4 "Don’t look at Guizhou’s problem in isolation. Guizhou’s problem is also a national problem. Eventually, someone must pay for it. The question is who." This is the nub of the problem. https://t.co/k5LaY4kfje via @WSJ" / Twitter

“We strongly contest that our collection of watches using rainbow colours and having a message of peace and love could be harmful for whomever,” Swatch Group CEO Nick Hayek Jr. said in a statement

Let's smash the political silence on Brexit - a Politics crowdfunding project in London by European Movement UK (crowdfunder.co.uk) Support for Brexit has plummeted. Only 32% of the public believe we were right to leave Europe*. So why are politicians so unwilling to admit there's a problem - let alone fix it? .... will 'a' party go for it at the next GE next year?..

Check out the flag on the floor..

Any thoughts on this ?

Mostly symbolic or will it be enforced ? France banned short domestic flights to get tough on emissions (qz.com)

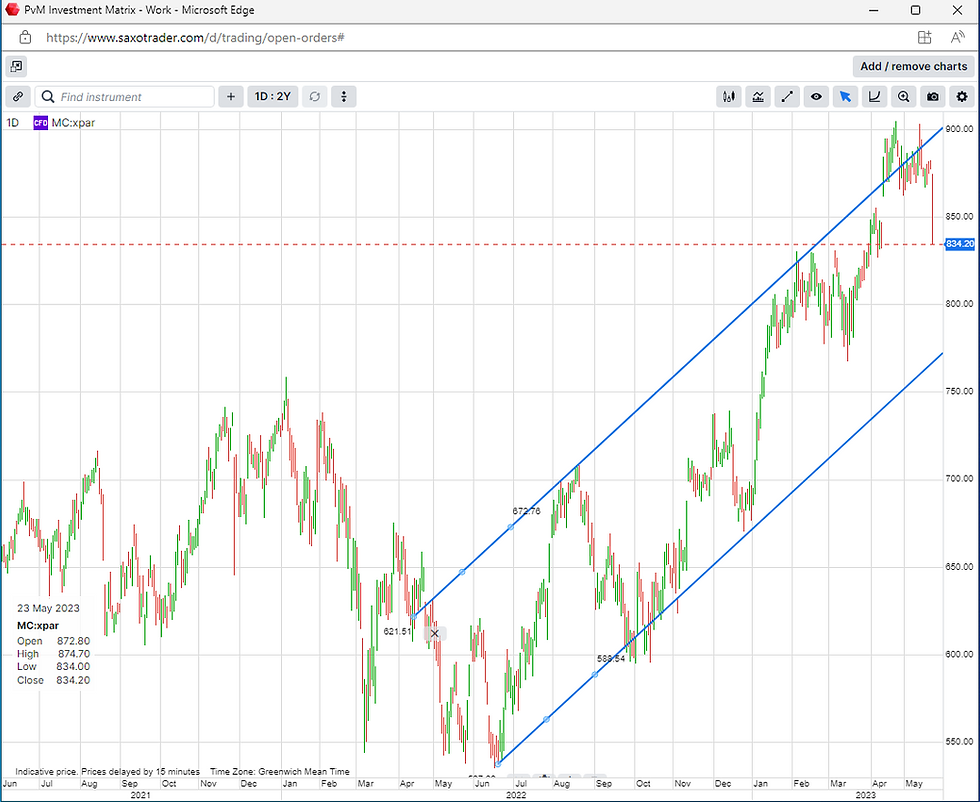

LVHM got way overdone, china peaked again, 'longs beware' - luxury sector !

Comments