BoJ up next / FOMC and U.S Treasury Refunding on Wed key focus

- Stéphan

- Oct 30, 2023

- 3 min read

The Bank of Japan faces a difficult monetary policy decision at its two-day meeting beginning Today, as the yen could further weaken if a policy tweak is not delivered as is expected by some in the financial markets.

Fed long been expected to do nothing at this meeting, all about presser, high for longer and so on, GDP was still strong (even if fuelled by debt..), employment still strong (let's see Friday NFP again) and infl expectations still around 4% 1y out

Wednesday when trading the refunding announcement is going to trump trading the Fed decision, all that matters at this moment is supply

Hartnett: "The Greatest credit event of all is disorderly rise in bond yields leading to Dollar debasement"

Goldman: "The Fed is done. Fed officials appear to have signaled that they will not be hiking at their November... and we interpret their recent comments to imply that most would prefer not to hike again". The Fed's first cut will be determined by when NFPs turn negative

Goldman Prime shocked by 12 Weeks of hedge fund shorting ss 'Mag 7' Trade Implodes: "The longest streak on our record"

U.S consumer expectations : US consumer expectations for 1y inflation spiked to 4.2%

U.S GDP for Q3, high number, but many looking underneath and growth is subsidised by massive debt

IMF : Emerging market and developing economies will need about $2 trillion annually by 2030 to achieve net-zero emissions, but the policies of major banks aren’t always aligned with that target

Toyota's chairman, Akio Toyoda, has long denied that electric vehicles are the only way forward for the automotive industry, and now that the segment's growth is slowing

ECB's Kazimir: Additional tightening could come if incoming data forces us to

Markets :

Big picture, the markets are realizing that the last 10-12years of free money are over, initially many hoped rate would be cuts back quickly, but consider that they maybe not, we certainly remain in the 'high for longer camp', which will clearly influence downward pressure on buybacks with a higher cost of capital and always a risk of recession ahead

Crude markets do not seem to be too concerned with ME tensions

Equity markets closing in on a pretty weak month, room for SPX500 to rally back towards 200dma from here in a corrective phase, but overall remain cautious into year-end, Powell and FOMC could actually be relatively hawkish still this week. Bank stocks to lowest point in 3years, even below the SVB lows in March and the Russell 2000 has hit the lowest levels since November 2020 (bit oversold short-term, let's see FED and Treasury refunding)

GOLD tops 2K again amidst risk weakness and ME tensions, back into big resistance though now $2030/2050 area

All eyes on Treasury Funding announcement this week and eventual ME tensions (crude no higher in fact CHF a little softer too, not by much but welcome), JPY on BoJ tomorrow

Hertz bought a bunch of Teslas, and the economics seem to be kind of terrible for them. The value of the cars has fallen more than they'd expected, and also repair costs for them are higher than for normal ICE cars Hertz Misses Quarterly Profit Estimates as Its Fleet Costs Rise - Bloomberg

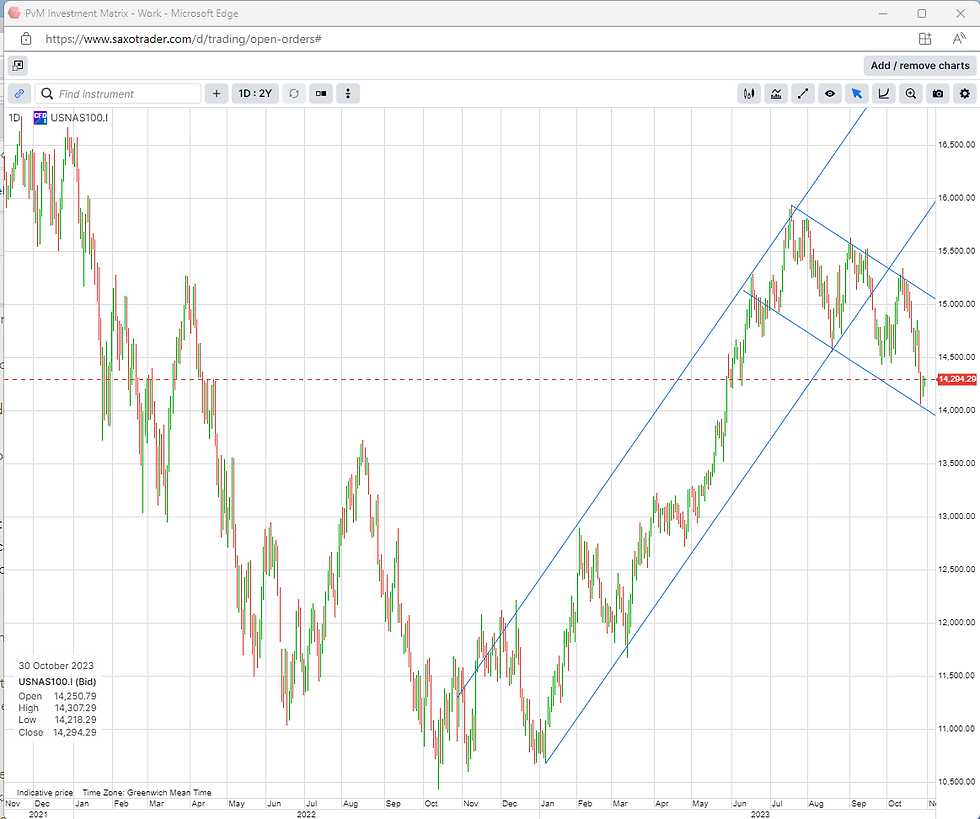

NASDAQ100 - holding where it should

SPX500 - in down trend still

EURCHF - tested the 0.9450 area lows of Sep last year - would need to trader 0.97600/0.9700+ for the bears to be changing their views/positioning

Comments